Table of Contents

Introduction

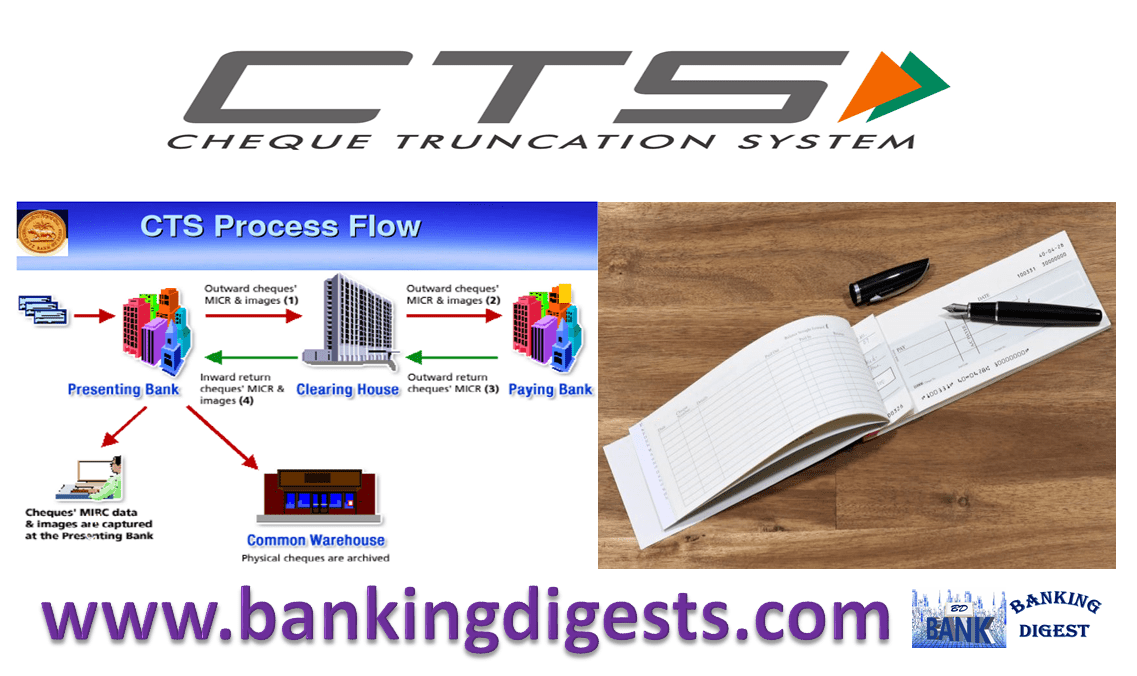

Truncation is the process of stopping the flow of the physical cheque issued by a drawer at some point by the presenting bank en-route to the paying bank branch. In its place, an electronic image of the cheque is transmitted to the paying branch through the clearinghouse, along with relevant information like data on the MICR band, date of presentation, presenting bank, etc. Cheque truncation thus obviates the need to move the physical instruments across bank branches, other than in exceptional circumstances for clearing purposes. This effectively eliminates the associated cost of movement of the physical cheques, reduces the time required for their collection, and brings elegance to the entire activity of cheque processing.

Importance of Cheque Truncation in India:

Importance of Cheque Truncation in India:

Cheque Truncation speeds up the process of collection of cheques resulting in better service to customers, reduces the scope of loss of instruments in transit, lowers the cost of collection of cheques, and removes reconciliation-related and logistics-related problems, thus benefiting the system as a whole.

With the other major products being offered in the form of RTGS and NEFT, the Reserve Bank has created the capability to enable inter-bank and customer payments online and in near-real-time. However, cheques continue to be the prominent mode of payment in the country. Reserve Bank of India has therefore decided to focus on improving the efficiency of the cheque clearing cycle. Offering Cheque Truncation System (CTS) is a step in this direction.

In addition to operational efficiency, CTS offers several benefits to banks and customers, including human resource rationalisation, cost-effectiveness, business process re-engineering, better service, adoption of the latest technology, etc. CTS, thus, has emerged as an important efficiency enhancement initiative undertaken by Reserve Bank in the Payments Systems arena.

Status of CTS implementation in the country:

CTS has been implemented in New Delhi, Chennai, and Mumbai with effect from February 1, 2008, September 24, 2011, and April 27, 2013, respectively. After the migration of the entire cheque volume from the MICR system to CTS, the traditional MICR-based cheque processing has been discontinued across the country.

Benefits of CTS to customers of banks:

The benefits are many. With the introduction of imaging and truncation, the physical movement of instruments is stopped. The electronic movement of images can facilitate a reduction in the clearing cycles as well. Moreover, there is no fear of the loss of instruments in transit. Further, limitations of the existing clearing system in terms of geography or jurisdiction can be removed, thus enabling consolidation and integration of multiple clearing locations managed by different banks with varying service levels into a nationwide standard clearing system with uniform processes and practices.

Under grid-based Cheque Truncation System clearing, all cheques drawn on bank branches falling within the grid jurisdiction are treated and cleared as local cheques. No outstation cheque collection charges/Speed Clearing charges are to be levied if the collecting bank and the paying bank are located within the jurisdiction of the same CTS grid even though they are located in different cities.

CTS also benefits issuers of cheques. The Corporates if needed can be provided with images of cheques by their bankers for internal requirements if any.

CTS thus brings elegance to the entire activity of cheque processing and clearing. The benefits from CTS could be summarized as follows –

- Shorter clearing cycle;

- Superior verification and reconciliation process;

- No geographical restrictions as to jurisdiction;

- Operational efficiency for banks and customers alike;

- Reduction in operational risk and risks associated with paper clearing;

- No collection charges for the collection of cheques drawn on a bank located within the grid.

Precautions required to be taken by the banks:

Banks should exercise care while affixing stamps on the cheque forms so that it does not interfere with the material portions such as date, payee’s name, amount, and signature. The use of rubber stamps, etc, should not overshadow the clear appearance of these basic features in the image. It is necessary to ensure that all essential elements of a cheque are captured in an image during the scanning process and banks/customers have to exercise appropriate care in this regard.

Res sir please provide proper trening cts clg from Rahul vaghada porbandar Gujarat