Table of Contents

INTRODUCTION

Bill finance is one of the major activities of the Banks. Under this type of lending, the Bank takes the bill drawn by the borrower on his (borrower’s) customer and pays him immediately deducting some amount as a discount/commission. The Bank then presents the Bill to the borrower’s customer on the due date of the Bill and collects the proceeds. If the bill is delayed, the borrower or his customer pays the Bank a pre-determined interest depending upon the terms of the transaction. The transaction is practically an advance against the security of the bill which is due for payment.

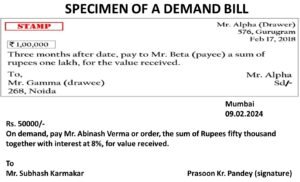

BILL OF EXCHANGE

Section 5 of the NI Act defines, “A bill of exchange is an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of a certain person or to the bearer of the instrument”.

A bill of exchange, therefore, is a written acknowledgement of the debt, written by the creditor and accepted by the debtor. There are usually three parties to a bill of exchange drawer, the acceptor or drawee and payee. Drawer himself may be the payee.

ESSENTIAL CONDITIONS OF A BILL OF EXCHANGE

(1) It must be in writing.

(2) It must be signed by the drawer.

(3) The drawer, drawee and payee must be certain.

(4) The sum payable must also be certain.

(5) It should be properly stamped.

(6) It must contain an express order to pay money and money alone.

For example, in the following cases, there is no order to pay, but only a request to pay. Therefore, none can be considered as a bill of exchange:

(a) “I shall be highly obliged if you make it convenient to pay Rs. 1000 to Suresh”.

(b) “Mr. Ramesh, please let the bearer have one thousand rupees, and place it to my account and oblige” However, there is an order to pay, though it is politely made, in the following examples:

(a) “Please pay Rs. 500 to the order of ‘A’.

(b) ‘Mr. A will oblige Mr. C, by paying to the order of’ P”.

(7) The order must be unconditional.

PARTIES TO A BILL OF EXCHANGE

Section 7 of the NI Act defines different parties of the bill of exchange.

- Drawer: The maker of a bill of exchange is called the ‘drawer’.

- Drawee: The person directed to pay the money is called the ‘drawee’,

- Acceptor: After a drawee of a bill has signed his assent upon the bill, or if there are more parts than one, upon one of such parts and delivered the same, or given notice of such signing to the holder or to some person on his behalf, he is called the ‘acceptor’.

- Payee: The person named in the instrument, to whom or to whose order the money is directed to be paid by the instrument is called the ‘payee’. He is the real beneficiary under the instrument.

- Endorser: When the holder transfers or endorses the instrument to anyone else, the holder becomes the ‘Endorser’.

- Endorsee: The person to whom the bill is endorsed is called an ‘Endorsee’.

- Holder & Holder in Due Course: A person who is legally entitled to the possession of the negotiable instrument in his name and to receive the amount thereof, is called a ‘holder’. ‘Holder in Due Course’ means any person who for consideration became the possessor of the bill (that is a person to whom the bill is transferred).

- Acceptor for honour: In case the original drawee refuses to accept the bill or to furnish better security when demanded by the notary, any person who is not liable for the bill, may accept it with the consent of the holder, for the honour of any party liable on the bill. Such an acceptor is called an ‘acceptor for honour’.

CLASSIFICATION OF BILLS

Bills can be classified as:

(1) Inland and foreign bills (Place wise)

(2) Time and demand bills (Period wise)

(3) Trade and accommodation bills (Nature wise)

(4) Clean and documentary bills (Documents wise)

(1) Inland and Foreign Bills

Inland bill: A bill is, named as an inland bill if drawn and made payable in India. A bill drawn or made in India & payable in or drawn upon any persons in India. The necessary requirements for inland bills are:

(a) It must be drawn in India on a person residing in India, whether payable in or outside India, or

(b) It must be drawn in India on a person residing outside India but payable in India.

The following are examples of Inland bills

(i) A bill is drawn by a merchant in Delhi on a merchant in Madras. It is payable in Bombay.

(ii) A bill is drawn by a Delhi merchant on a person in London but is made payable in India.

(iii) A bill is drawn by a merchant in Delhi on a merchant in Madras. It is accepted for payment in Japan.

Foreign Bill: A bill which is not an inland bill is a foreign bill. The following are the foreign bills:

- A bill drawn outside India and made payable in India.

- A bill drawn outside India on any person residing outside India.

- A bill drawn in India on a person residing outside India and made payable outside India.

- A bill drawn outside India on a person residing in India.

- A bill drawn outside India and made payable outside India.

Bill of exchange in sets: When the bills are in sets, (i.e. first, second or third copy) as in the case of foreign trade transactions, the stamp duty is paid only on one part and only one part is required to be accepted.

Bills in sets (Secs. 132 and 133): The foreign bills are generally drawn in sets of three, and each set is termed as a ‘via’. The stamp duty is paid only on one part and only one part is required to be accepted. As soon as any of the sets is paid, the others become inoperative. These bills are drawn in different parts. They are drawn to avoid their loss or miscarriage during transit. Each part is dispatched separately. To avoid delay, all the parts are sent on the same day; by different modes of conveyance.

(2) Time and Demand Bill

Time or Usance bills: A bill payable after a fixed time is termed as a time bill. In other words, bill payable “after date” is a time or usance bill.

Demand bill: A bill payable at sight or on demand is termed as a demand bill.

(3) Trade and Accommodation Bill

Trade bill: A bill drawn and accepted for a genuine trade transaction is termed as a “trade bill”.

Accommodation bill: A bill drawn and accepted not for a genuine trade transaction but only to provide financial help to some party is termed an “accommodation bill”.

Example: A, requires money for three months. He induces his friend B to accept a bill of exchange drawn on him for Rs. 1,000 for three months. The bill is drawn and accepted. The bill is an “accommodation bill”. A may get the bill discounted from his bankers immediately, paying a small sum as a discount. Thus, he can use the funds for three months and then just before maturity, he may remit the money to B, who will meet the bill on maturity. In the above example, A is the “accommodated party” while B is the “accommodating party”.

(4) Clean and documentary bills

Clean bills: A clean bill is a bill of exchange drawn as per requirements of the NI Act and is not supported by documents of title of goods. Clean bills are drawn normally to effect the discharge of a debt or claim.

Documentary bills: A bill of exchange accompanying documents of title of goods is called a documentary bill. These bills are drawn to claim the price of goods supplied. Examples of title of goods are Railway receipts, warehouse receipts, bills of lading, dock warrants etc.

Stamp duty on bills: The advalorem stamp duty is payable on usance bill (i.e. as per amount and usance period). Following usance bills are exempted from payment of stamp duty (a) with a usance period of up to 90 days, where the bank is a party to the bill since 1989 (b) export bills 2004. On-demand bills, the stamp duty is exempted.

Acceptance of a bill of exchange: The acceptance of a bill means signing by the drawer of a bill, on the face with or without the words accepted and delivery thereof or giving notice of signing, to the holder of the bill. There are 2 types of acceptances i.e. general acceptance and qualified acceptance. In cages of several drawees not being partners, each of them can accept it for himself but not others without their authority (Sec 34).

Dishonour of bill of exchange: A bill of exchange is said to be dishonoured either by non-acceptance (when the drawee defaults in acceptance) or by non-payment (when the acceptor/drawee makes default in payment). Similarly, where the drawee is incompetent to contract or acceptance is qualified, the bill is said to be dishonoured (Sections 91 & 92).

Notice of dishonour: When a bill is dishonoured, the holder thereof must give notice that the instrument has been so dishonoured to all parties whom the holder seeks to make jointly liable thereon. It is not necessary to give notice to the maker of the dishonoured promissory note, or the drawee or acceptor of the dishonoured bill of exchange or cheque (Section 93).

Presentation for acceptance: As per Section 61, a usance bill payable after sight and bills payable on a fixed date (and not demand bills) are required to be presented to the drawee for acceptance to make him liable and also for calculation of the due date.

RULES FOR DUE DATE CALCULATION

- A Demand bill is payable on demand or at sight.

- A Usance bill should be presented for acceptance within a reasonable time.

- The drawee is allowed 48 hours excluding public holidays to accept the bill.

- If a usance bill is payable after the date, its due date is calculated from the date of the bill and if it is payable after sight, its due date is calculated from the date of acceptance.

- A 3-day grace period is given to every Usance Promissory Note or BOE.

- Where the due date is already given by the drawer, no grace period is to be given.

- Instruments payable in instalments, the days of grace are to be allowed for each instalment.

- When the maturity date is a public holiday: As per sec 25 of the N I Act, such instrument be payable on the next preceding business day i.e. the previous business day.

- Declaration of Public Holiday: u/s 25 of N I Act 1881, the public holiday includes Sunday and any other day declared by the Central Govt. by notification in the Official Gazette (this power has been delegated to the state government).

| Date of bill | Presented on | Accepted on | Payment terms | Due date |

| 26.02.24 | 27.02.24 | 28.02.24 | 30 days after acceptance. | 01.04.24 |

| 26.12.23 | 26.12.23 | 28.12.23 | 45 days after the date. | 12.02.24 |

| 20.12.23 | 21.12.23 | 23.12.23 | 1 month after sight. | 25.01.24 |

| 26.02.24 | 27.02.24 | 28.02.24 | 3 months after acceptance. | 31.05.24 |

| 26.12.23 | 26.12.23 | 28.12.23 | 2 months after date. | 29.02.24 |

TYPES OF BILL FINANCE

A banker offers the following types of bill finance:

- Bill Purchase (B.P.)

- Bill Discount (B.D.)

- Advance against Bill for Collection (A.B.C.)

Bill Purchase

When a bank negotiates bills payable on demand, whether clean or documentary, the facility is known as bill purchase. The face value of the bill is immediately paid to the holder. The bank after purchasing the bill, becomes the holder in due course of the bill and acquires all the rights of ownership over the instrument. Bill purchase facility is extended generally in the case of bills payable on demand. However, in the case of usance bills also this is extended when the due date of the bill is not readily known at the time of extending the facility. Such a situation arises when the bill is drawn payable after some days after sight. The due date of such a bill is known when the bill is presented to the drawee and the period of usance commences from the date of presentation. In the case of a demand bill, the date on which it will be paid is uncertain. The drawee may pay the bill as soon as it is presented to him or he may take a few days to do so. Hence, as in the case of cheque purchase, interest for the estimated time for realization of the bill, say for 15 days, is recovered at the time of purchase. Additional interest is recovered or excess interest refunded on realization of the bill according to the actual number of days taken to realize the bill. In case of dishonour of the bill, the amount is recovered from the customer.

Bill Discount

In the case of a Usance Bill, the date of payment is certain as it becomes payable a certain number of days after it is accepted or from the date of the bill. Hence we may be able to calculate the exact amount of interest due on the bill and recover it upfront. Interest recovered at the time of advance is called a “discount”. When money is against a usance bill for collection, it is called Bill Discounting. In the case of bills purchase also interest is recovered at the time of advance. However, it is only an estimated amount and not the exact amount due. Hence it is called commission and not discount.

Advance against Bill for Collection

Banks also give advance against the bills, which are in the course of the collection known as an advance against the bill for collection. Under this facility, a prescribed margin is kept by the bank and the amount, in consideration of this is allowed to the customer. The bill thereafter is sent for collection.

In all cases, the legal effect is that the banker, who lends money, becomes the holder in due course the bill.

Bills Discounting and Purchase are less risky than CC facility for the following reasons:

Self-Liquidating – Bills will be repaid when the buyer pays the bills on the due date.

Easy to monitor – If the bill is not paid on the due date it will be known immediately and the bank can speedily take further action for recovery of the advance.

More secure – The goods covered by demand bills can be taken delivery of by the buyer only after paying the bill. Hence, if the bill is not repaid the bank can take delivery of the goods and sell it to recover the advance. In the case of a usance bill, the bank can proceed against the seller and the buyer for recovery. Further, since a bill is a negotiable instrument, on filing a suit, consideration need not be proved.

Leave a Reply