Table of Contents

INTRODUCTION

Letter of Credit is a guarantee letter issued by a bank in international trade in favor of the exporter that a buyer’s payment will be paid on time. If the buyer is unable to make payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase. Now in simple words, If LC is opened in the seller’s name as beneficiary, the seller will receive the amount through the buyer’s bank (opening bank) at the agreed time.

ADVANTAGE OF LETTER OF CREDIT

Letters of credit are often used in international transactions to ensure that payment will be received. Due to the nature of international dealings including factors such as distance, differing laws in each country, and difficulty in knowing each party personally, the use of letters of credit has become a very important aspect of international trade. The bank also acts on behalf of the buyer (holder of the letter of credit) by ensuring that the supplier will not be paid until the bank receives a confirmation that the goods have been shipped.

All Letters of Credit for export-import trade are handled under the guidelines of Uniform Customs and Practice of Documentary Credit of the International Chamber of Commerce (UCPDC 600). The ICC Banking Commission approved UCPDC 600 on 25 October 2006, which came into effect on 1st July 2007.

International trade covers a very large distance between two countries and exporters and importers are not known to each other. Letter of Credit plays a major role in this transaction. Both exporter and importer benefit from doing business through the letter of credit.

Major advantages to a buyer (importer) from a letter of credit are as follows:

- No cash advance payment has to be made to the seller;

- Seller is paid only after shipment and delivery of documents within the LC validity;

- Possibility to obtain more favorable payment terms;

- Shipment schedule ensured.

Major advantages to the seller (exporter) from a letter of credit are as follows:

- Obligation of the buyer’s bank for payment;

- Payment is assured if credit terms are fulfilled;

- The date of receipt of payment can be determined;

- Seller need not bother about the fluctuation of currency;

- Seller need not bother about the import regulation of the buyer country.

- A financing possibility by discounting receivables under LC.

NEED OF THE LETTER OF CREDIT

Letter of credit is an important tool of international Trade. Exporters and Importers belong to two different countries having different trading environments and different rules and regulations. Letter of credit can resolve the Complications/Complexities/Contradictions that arise in international trade due mainly to the involvement of two countries separated by differences in –

- Physical barriers – long distances

- Political systems and legal systems

- Currencies used in trade

- Trade and exchange regulations

- Markets and marketing conditions

- Trade practices

- Financial and commercial conditions

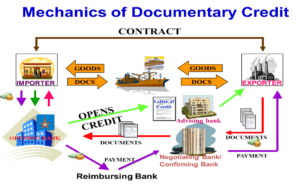

PARTIES OF LETTER OF CREDIT

Various parties of the LC are as under:

Applicant

The applicant is the party who opens the Letter of Credit. He is the buyer/importer of the goods (generally a borrower of the issuing bank). The applicant arranges to open a letter of credit with his bank as per the terms and conditions of the Purchase order and the business contract between buyer and seller. The applicant has to make a payment if documents as per LC are delivered, whether the goods are as per the contract between the buyer and beneficiary or not.

Beneficiary party

The seller or exporter is the beneficiary in whose favor the letter of credit is issued. It gets payment against documents as per LC from the nominated bank within the validity period for negotiation,

Issuing Bank

The issuing Bank is the bank that opens a letter of credit. The letter of credit is created by the issuing bank which takes responsibility for paying the amount on receipt of documents from the supplier of goods (beneficiary under LC).

Advising Bank

Advising bank, as a part of the letter of credit takes responsibility for communicating with necessary parties under letter of credit and other required authorities. The advising bank is the party that sends documents under the Letter of Credit to the opening bank.

Confirming Bank

Confirming bank is a party to the letter of credit confirms and guarantees to undertake the responsibility of payment or negotiation acceptance under the credit. The bank which adds its guarantee to the LC opened by another Bank and thereby undertakes responsibility for payment/ acceptance/ negotiation/ incurring deferred payment under the credit in addition to that of the Issuing Bank.

Negotiating Bank

Negotiating Bank, who negotiates documents delivered to the bank by the beneficiary of LC. The negotiating bank is the bank that verifies documents and confirms the terms and conditions under LC on behalf of the beneficiary to avoid discrepancies.

Reimbursing Bank

The reimbursing bank is the party authorized to honor the reimbursement claim of negotiation/ payment/ acceptance.

DIFFERENT TYPES OF LETTER OF CREDIT

Different types of LCs are as under:

Revocable & Irrevocable LCs

A revocable letter of credit is one which can be cancelled or amended by the issuing bank at any time and without prior notice to or consent of the beneficiary. An Irrevocable Letter of Credit is one which cannot be cancelled or amended without the consent of all parties concerned.

According to the UCPDC 600, all LCs are irrevocable now, hence this type of revocable LC is obsolete. Irrevocable LC is a letter of credit that does not allow the issuing bank to make any changes without the approval of the beneficiary, applicant bank, and confirming bank, if any.

Deferred or Usance LC & Sight LC

A letter of credit, which ensures payment after a certain period. The date of payment is accepted by both buyer and seller. The bank may review the documents early but the payment to the beneficiary is made after the agreed time passes. It is also known as Usance LC.

A letter of credit that demands payment on the submission of the required documents. The bank reviews the documents and pays the beneficiary if the documents meet the conditions of the letter.

Restricted LC

A restricted letter of credit refers to a letter of credit that restricts negotiation with the bank that the issuing bank has nominated in the credit. It is one wherein a specified bank is designated to pay, accept, or negotiate payment will be made. In a restricted negotiable letter of credit, the authorization from the issuing bank to pay the beneficiary is restricted to a specific nominated bank. An unrestricted letter of credit may be negotiated through any bank of the beneficiary’s choice.

Transferable LCs

It is an LC, where the beneficiary is entitled to transfer the LC, in whole or in part, to the 2nd beneficiary/s (supplier of the beneficiary). The 2nd beneficiary, however, cannot transfer it further, but it can transfer the unused portion, back to the original beneficiary. It is transferable only once.

Back-to-Back Credit

A pair of LCs in which one is to the benefit of a seller who is not able to provide the corresponding goods for unspecified reasons. In that event, a second credit is opened for another seller to provide the desired goods. Back-to-back is issued to facilitate intermediary trade. Intermediate companies such as trading houses are sometimes required to open LCs for a supplier and receive Export LCs from the buyer.

Red Clause LC

It refers to a packing or anticipatory credit, which has a clause permitting the correspondent bank in the exporter’s country to grant advance to the beneficiary at the issuing bank’s responsibility. These advances are adjusted from the proceeds of the bills negotiated.

Green Clause LC

It permits the advances for storage of goods in a warehouse in addition to pre-shipment advance. It is an extension of the red clause LC.

Standby Credits

It is similar to a performance bond or guarantee, but issued in the form of LC. The beneficiary can submit his claim using a draft accompanied by the requisite documentary evidence of performance, as stipulated in the credit.

Documentary Credits

When LC specifies that the bills drawn under LC must – accompany documents of title to goods such as RRs or MIRs or Bills of lading etc. it is termed as Documentary Credit. If any such documents are not called, the credit is said to be Clean Credit.

Revolving Credits

These LCs provide that the number of drawings made there under would be reinstated and made available to the beneficiary again and again for further drawings during the currency of credit provided the applicant makes the payment of documents earlier negotiated. At times, an overall turnover cap is also stipulated.

PROCEDURE FOR OPENING LETTER OF CREDIT

The buyer entered into a contract with an overseas supplier to import machinery at his factory. As per their contract, the buyer needs to open a Letter of credit (LC) in favor of the exporter/seller. Banker has to verify the following documents of the buyer/importer:

- IEC No. of the buyer,

- Whether Goods/Services under LC is permitted under Foreign Trade Policy or not,

- Import License of the buyer if applicable,

- FEMA Guidelines about the items imported.

The customer’s financial standing, line of business, frequency of imports, sales, account turnover, satisfactory track record of the importer for import of goods, etc. are also scrutinized.

SWIFT CODE

SWIFT is the short form of “Society for Worldwide Interbank Financial Telecommunication”. In simple terms swift has two main roles in international financial transactions, firstly SWIFT provides a secure communications platform by which financial institutions can communicate with each other reliably & fast and secondly SWIFT establishes standard message formats that can be used on secure SWIFT platforms.

Today banks use the SWIFT platform to communicate with each other when sending a wire transfer, issuing a letter of credit, advising a discrepancy message, etc. Each of these message formats has a different code, which is called swift message type.

For example, a bank must use MT700 (MT means Message Type) Issue of a Documentary Credit when issuing a letter of credit and MT 734 advice of a refusal when giving its refusal message.

According to the current letters of credit rules, UCP 600, a letter of credit will be deemed to be an operative letter of credit, if it is transmitted via an authenticated electronic platform such as SWIFT.

STANDARD FORMS OF DOCUMENTS

When making payment for a product on behalf of its customer, the issuing bank must verify that all documents and drafts conform precisely to the terms and conditions of the letter of credit. Although the credit can require an array of documents, the most common documents that must accompany the draft include:

Commercial Invoice

The billing for the goods and services. It includes a description of merchandise, price, FOB origin, and name and address of buyer and seller. The buyer and seller information must correspond exactly to the description in the letter of credit. Unless the letter of credit specifically states otherwise, a generic description of the merchandise is usually acceptable in the other accompanying documents.

Bill of Exchange

This is a financial document. Payment is made on this document. In a letter of credit transaction, the right to draw a bill is conferred only on the beneficiary. The bill amount should be within the limit fixed in the letter of credit. The tenor, endorsement, and drawee should be the same as given in the letter of credit.

Transport Documents

The mode of dispatch of goods or the transporting of goods would depend on the terms of the contract between buyer and seller and the same is incorporated in the letter of credit. The two main modes of transport of goods are either by sea or by air. These are the important transport documents used in LC.

Bill of Lading

A document evidencing the receipt of goods for shipment and issued by a freight carrier engaged in the business of forwarding or transporting goods. The documents evidence control of goods. They also serve as a receipt for the merchandise shipped and as evidence of the carrier’s obligation to transport the goods to their proper destination.

Airway Bill

This is a document, which evidences that the goods have been received by an airline company or its agent. Unlike a bill of lading an airway bill does not carry with it the right to the goods, i.e., it is not a document of title to the goods.

Postal Parcel Receipt and Courier Receipts

When the goods to be sent are small in quantity, then they can be sent through post or courier. The documents issued by the postal department or courier are similar in nature to the airway bill.

Warranty of Title

A warranty given by a seller to a buyer of goods that states that the title being conveyed is good and that the transfer is rightful. This is a method of certifying a clear title-to-product transfer. It is generally issued to the purchaser and issuing bank agreeing to indemnify and hold both parties harmless.

Insurance Document

The goods shipped, if required to be insured under the terms of the letter of credit should be so insured and the insurance document as required in the letter of credit should be enclosed with the other documents. The type of insurance cover should be the same as specified in the credit.

Letter of Indemnity

Specifically indemnifies the purchaser against a certain stated circumstance. Indemnification is generally used to guarantee that shipping documents will be provided in good order when available.

RISKS IN LETTER OF CREDIT TRANSACTIONS

Letter of credit transactions are not risk-free. The risks inherent in these types of transactions include:

Fraud Risks: The payment will be obtained for non-existent or worthless merchandise against presentation by the beneficiary of forged or falsified documents. Credit itself may be funded.

Sovereign and Regulatory Risks: The performance of the Documentary Credit may be prevented by government action outside the control of the parties.

Legal Risks: Possibility that the performance of a documentary credit may be disturbed by legal action relating directly to the parties and their rights and obligations under the documentary credit.

Force majeure risk: In which completion of the transaction is prevented by an external force, such as war or natural disaster

INCOTERMS (INTERNATIONAL COMMERCIAL TERMS)

Incoterms are a set of rules that define the responsibilities of sellers and buyers for the delivery of goods under sales contracts. They are published by the International Chamber of Commerce (ICC) and are widely used in commercial transactions. Shippers worldwide use standard trade definitions (called Incoterms) to spell out who’s responsible for the shipping, insurance, and tariffs on an item; they’re commonly used in international contracts and are protected by the International Chamber of Commerce copyright. Incoterms significantly reduce misunderstandings among traders and thereby minimize trade disputes and litigation. Familiarize yourself with Incoterms so you can choose terms that will enable you to provide excellent customer service and clearly define who is responsible for which charges.

“Incoterms” is a registered trademark of the ICC. The first work published by the ICC on international trade terms was issued in 1923, with the first edition known as Incoterms published in 1936. The Incoterms rules were amended in 1953, 1967, 1976, 1980, 1990, and 2000, with the eighth version— Incoterms 2010.

INCOTERMS 2020

The International Chamber of Commerce (ICC) has already published Incoterms® 2020 rules that will be in effect as of January 1, 2020. The latest version is that of Incoterms 2020 which is expected to be in effect for a decade, until December 2029.

Incoterms® 2020 to choose are divided into four groups:

- E-Group (EXW)

- F-Group (FCA – FAS – FOB)

- C-Group (CPT – CIP – CFR – CIF)

- D-Group (DAP – DPU (Delivered at Place Unloaded) – DDP)

RULES FOR ANY MODE OR MODES OF TRANSPORT

EXW – Ex Works:

“Ex Works” means that the seller delivers when it places the goods at the disposal of the buyer at the seller’s premises or another named place (i.e., works, factory, warehouse, etc.). The seller does not need to load the goods on any collecting vehicle, nor does it need to clear the goods for export, where such clearance is applicable.

FCA – Free Carrier

“Free Carrier” means that the seller delivers the goods to the carrier or another person nominated by the buyer at the seller’s premises or another named place. The parties are well advised to specify as clearly as possible the point within the named place of delivery, as the risk passes to the buyer at that point.

CPT – Carriage Paid to

“Carriage Paid To” means that the seller delivers the goods to the carrier or another person nominated by the seller at an agreed place (if any such place is agreed between parties) and that the seller must contract for and pay the costs of carriage necessary to bring the goods to the named place of destination.

CIP – Carriage and Insurance Paid to

“Carriage and Insurance Paid to” means that the seller delivers the goods to the carrier or another person nominated by the seller at an agreed place (if any such place is agreed between parties) and that the seller must contract for and pay the costs of carriage necessary to bring the goods to the named place of destination. The seller also contracts for insurance cover against the buyer’s risk of loss of or damage to the goods during the carriage. The buyer should note that under CIP the seller is required to obtain insurance only on minimum cover. Should the buyer wish to have more insurance protection, it will need either to agree as much expressly with the seller or to make its extra insurance arrangements.

DAT – Delivered at Terminal

“Delivered at Terminal” means that the seller delivers when the goods, once unloaded from the arriving means of transport, are placed at the disposal of the buyer at a named terminal at the named port or place of destination. “Terminal” includes a place, whether covered or not, such as a quay, warehouse, container yard or road, rail or air cargo terminal. The seller bears all risks involved in bringing the goods to and unloading them at the terminal at the named port or place of destination.

DAP – Delivered at Place

“Delivered at Place” means that the seller delivers when the goods are placed at the disposal of the buyer on the arriving means of transport ready for unloading at the named place of destination. The seller bears all risks involved in bringing the goods to the named place.

DDP – Delivered Duty Paid

“Delivered Duty Paid” means that the seller delivers the goods when the goods are placed at the disposal of the buyer, cleared for import on the arriving means of transport ready for unloading at the named place of destination. The seller bears all the costs and risks involved in bringing the goods to the place of destination and should clear the goods not only for export but also for import, to pay any duty for both export and import, and to carry out all customs formalities.

RULES FOR SEA AND INLAND WATERWAY TRANSPORT

FAS – Free Alongside Ship

“Free Alongside Ship” means that the seller delivers when the goods are placed alongside the vessel (e.g., on a quay or a barge) nominated by the buyer at the named port of shipment. The risk of loss of or damage to the goods passes when the goods are alongside the ship, and the buyer bears all costs from that moment onwards.

FOB – Free On Board

“Free On Board” means that the seller delivers the goods on board the vessel nominated by the buyer at the named port of shipment or procures the goods already so delivered. The risk of loss of or damage to the goods passes when the goods are on board the vessel, and the buyer bears all costs from that moment onwards.

CFR – Cost and Freight

“Cost and Freight” means that the seller delivers the goods on board the vessel or procures the goods already so delivered. The risk of loss of or damage to the goods passes when the goods are on board the vessel. the seller must contract for and pay the costs and freight necessary to bring the goods to the named port of destination.

CIF – Cost, Insurance and Freight

“Cost, Insurance, and Freight” means that the seller delivers the goods on board the vessel or procures the goods already so delivered. The risk of loss of or damage to the goods passes when the goods are on board the vessel. The seller must contract for and pay the costs and freight necessary to bring the goods to the named port of destination. The seller also contracts for insurance cover against the buyer’s risk of loss of or damage to the goods during the carriage. The buyer should note that under CIF the seller is required to obtain insurance only on minimum cover. Should the buyer wish to have more insurance protection, it will need either to agree as much expressly with the seller or to make extra insurance arrangements.

UCPDC (UNIFORM CUSTOMS AND PRACTICE FOR DOCUMENTARY CREDITS) 600

This revision of the Uniform Customs and Practice for Documentary Credits (commonly called “UCP”) is the sixth revision of the rules since they were first promulgated in 1933. It is the fruit of more than three years of work by the International Chamber of Commerce’s (ICC) Commission on Banking Technique and Practice. UCP 600 is the latest revision of the Uniform Customs and Practice that governs the operation of letters of credit. UCP 600 comes into effect on 01 July 2007. The 39 articles of UCP 600 are a comprehensive and practical working aid to bankers, lawyers, importers, exporters, transport executives, educators, and everyone involved in letter of credit transactions worldwide.

COMMON DEFECTS IN DOCUMENTATION

About half of all drawings presented contain discrepancies. A discrepancy is an irregularity in the documents that causes them to be in non-compliance to the letter of credit. Requirements outlined in the letter of credit cannot be waived or altered by the issuing bank without the express consent of the customer. The beneficiary should prepare and examine all documents carefully before presentation to the paying bank to avoid any delay in receipt of payment. Commonly found discrepancies between the letter of credit and supporting documents include:

- The letter of Credit has expired before the presentation of the draft.

- Bill of Lading evidences delivery before or after the date range stated in the credit.

- Stale-dated documents.

- Changes included in the invoice are not authorized in the credit.

- Inconsistent description of goods.

- Insurance document errors.

- The invoice amount is not equal to the draft amount.

- Ports of loading and destination are not as specified in the credit.

- The description of the merchandise is not as stated in credit.

- A document required by the credit is not presented.

- Documents are inconsistent as to general information such as volume, quality, etc.

- Names of documents are not exactly as described in the credit. Beneficiary information must be exact.

- The invoice or statement is not signed as stipulated in the letter of credit.

When a discrepancy is detected by the negotiating bank, a correction to the document may be allowed if it can be done quickly while remaining in the control of the bank. If time is not a factor, the exporter should request that the negotiating bank return the documents for corrections.

Leave a Reply