Table of Contents

INTRODUCTION

In India, the Negotiable Instruments Act was passed during 1881 which came into force from March 01, 1882. Originally, it had 137 Sections. Sections 138 to 142 were added in 1988, and Sections 143 to 147 were added during December 2002. At present it has 147 sections and 17 Chapters. It extends to the whole of India. According to Section 13 (a) of the Act, Negotiable Instruments means Promissory Note (PN), Bill of Exchange (BOE) and Cheque.

Features of Negotiable Instruments are as under:

- A negotiable instrument is freely used by the parties in their business deal as a medium of payment.

- The word ‘negotiable’ means the transfer of ownership of the instrument from one person to another person for consideration.

- Transferred Negotiable Instruments will further transfer without any restriction;

- The transferee taking the instrument for value and in good faith, gets better and absolute title despite any defect in the title of the transferor.

- The property in a negotiable instrument, i.e. the complete right of ownership, and not merely the possession passes, in the case of bearer instruments, by mere delivery, and in case of order instruments, by endorsement and delivery.

- The holder in due course is not, in any way, affected by the defect of the title of his transferor or any prior party.

- The holder in due course can sue upon a negotiable instrument in his name.

- The transferee of a negotiable instrument is known as ‘holder in due course.’ A bona fide transferee for value is not affected by any defect of title on the part of the transferor or of any of the previous holders of the instrument.

- The instrument may be defined as a written document that creates a right in favour of some person.

- Negotiable instrument means Promissory Note (PN), Bill of Exchange (BE), and Cheque payable to order or bearer.

DIFFERENT TYPES OF NEGOTIABLE INSTRUMENTS

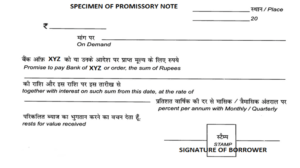

PROMISSORY NOTES

Section 4 of the Act defines, “A promissory note is an instrument in writing (note being a bank-note or a currency note) containing an unconditional undertaking, signed by the maker, to pay a certain sum of money to or to the order of a certain person, or to the bearer of the instruments.” Example- If A writes “I promise to pay B or order Rs. 5000”.

SPECIMEN OF A PROMISSORY NOTES

An instrument to be a promissory note must possess the following elements:

- It must be in writing,

- It must certainly be an express promise or clear understanding to pay a certain sum of money,

- The promise should be to pay money and money only,

- Promise to pay must be unconditional,

- It should be signed by the maker,

- The maker & payee must be certain.

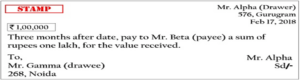

BILL OF EXCHANGE

Section 5 of the Act defines, “A bill of exchange is an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of a certain person or to the bearer of the instrument”.

A bill of exchange, therefore, is a written acknowledgment of the debt, written by the creditor and accepted by the debtor. There are usually three parties to a bill of exchange drawer, the acceptor or drawee and the payee. Drawer himself may be the payee.

For example, Mr. Alpha directed Mr. Gama for payment of Rs. 100,000 to Mr. Beta.

SPECIMEN OF A DEMAND BILL

Essential conditions of a bill of exchange

(1) It must be in writing.

(2) It must be signed by the drawer.

(3) The drawer, drawee, and payee must be certain.

(4) The sum payable must also be certain.

(5) It should be properly stamped.

(6) It must contain an express order to pay money and money alone.

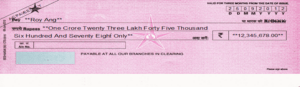

CHEQUES

Section 6 of the Act defines “A cheque is a bill of exchange drawn on a specified banker, and not expressed to be payable otherwise than on demand”.

SPECIMEN OF A CHEQUE

A cheque is a bill of exchange with two more qualifications, namely,

(i) it is always drawn on a specified banker, and

(ii) it is always payableon demand. Consequently, all cheque are bill of exchange, but all bills are not cheque.

A cheque must satisfy all the requirements of a bill of exchange; that is, it must be signed by the drawer and must contain an unconditional order on a specified banker to pay a certain sum of money to or to the order of a certain person or to the bearer of the cheque. It does not require acceptance.

OTHER NEGOTIABLE INSTRUMENTS

The following are also considered as negotiable instruments:

- Demand Draft,

- Hundi,

- Traveller Cheque,

- Gift Cheque,

- Dividend Warrant,

- Interest Warrant,

- Bankers’ Cheque,

- Pay Order,

- Commercial Paper.

NOT A NEGOTIABLE INSTRUMENTS

The following are not Negotiable Instruments:

- Deposit Receipt,

- NSC,

- Postal Order,

- Share Certificate,

- Bill of Lading,

- Lorry Receipt,

- Airway Bill,

- Railway Receipt,

- Stock Invest,

- Dock Warrant

PARTIES TO NEGOTIABLE INSTRUMENTS

- Drawer: The maker of a bill of exchange is called the ‘drawer’.

- Drawee: The person directed to pay the money by the drawer is called the ‘drawee’.

- Payee: The person named in the instrument, to whom or to whose order the money is directed to be paid by the instrument is called the ‘payee’. He is the real beneficiary under the instrument.

- Endorser: When the holder transfers or endorses the instrument to anyone else, the holder becomes the ‘endorser’.

- Endorsee: The person to whom the bill is endorsed is called an ‘endorsee’.

- Holder: A person who is legally entitled to the possession of the negotiable instrument in his own name and to receive the amount thereof, is called a ‘holder’. He is either the original payee or the endorsee. In case the bill is payable to the bearer, the person in possession of the negotiable instrument is called the ‘holder’.

- Holder in Due Course: defined in Section 9 of the NI Act. Holder in due course is a person who became possessor of a NI for valuable consideration, in good faith, before becoming due, and without having any reason to believe that the person transferring the instrument was not entitled thereto. if before the amount mentioned in it became payable, and without having sufficient cause to believe that any defect existed in the title of the person from whom he derived his title.

CLASSIFICATION OF BILLS

Bills can be classified as:

(1) Inland and foreign bills. (Place wise)

(2) Time and demand bills. (Period wise)

(3) Trade and accommodation bills. (Nature wise)

(1) Inland and Foreign Bills

Inland bill

A bill is, named an inland bill if drawn and made payable in India. A bill drawn or made in India & payable in or drawn upon any persons in India. The requirements for inland bills are:

(a) It must be drawn in India on a person residing in India, whether payable in or outside India, or

(b) It must be drawn in India on a person residing outside India but payable in India.

Foreign Bill

A bill which is not an inland bill is a foreign bill. The following are the foreign bills:

- A bill is drawn outside India and made payable in India.

- A bill is drawn outside India on any person residing outside India.

- A bill is drawn in India on a person residing outside India and made payable outside India.

- A bill is drawn outside India on a person residing in India.

- A bill is drawn outside India and made payable outside India.

(2) Time and Demand Bill

Time or Usance bills

A bill payable after a fixed time is termed as a time bill. In other words, bill payable “after date” is a time or usance bill.

Demand bill

A bill payable at sight or on demand is termed a demand bill.

(3) Trade and Accommodation Bill

Trade bill

A bill drawn and accepted for a genuine trade transaction is termed a “trade bill”.

Accommodation bill

A bill drawn and accepted not for a genuine trade transaction but only to provide financial help to some party is termed an “accommodation bill”.

Example: A, needs money for three months. He induces his friend B to accept a bill of exchange drawn on him for Rs. 1,000 for three months. The bill is drawn and accepted. The bill is an “accommodation bill”. A may get the bill discounted from his bankers immediately, paying a small sum as a discount. Thus, he can use the funds for three months and then just before maturity, he may remit the money to B, who will meet the bill on maturity. In the above example, A is the “accommodated party” while B is the “accommodating party”.

ACCEPTANCE OF BILL OF EXCHANGE

The acceptance of a bill means signing by the drawer of a bill, on face with or without the words accepted and delivery thereof or giving notice of signing, to the holder of the bill. There are 2 types of acceptances i.e. general acceptance and qualified acceptance. In cases of several drawees not being partners, each of them can accept it for himself but not others without their authority (Sec 34).

Dishonour of bill of exchange

A bill of exchange is said to be dishonoured either by non-acceptance (when the drawee defaults in acceptance) or by non-payment (when the acceptor/drawee makes defaults in payment). Similarly, where the drawee is incompetent to contract or acceptance is qualified, the bill is said to be dishonoured (Sections 91 & 92).

Presentation for acceptance

As per Section 61, a usance bill payable after sight and bills payable on a fixed date (and not demand bills) require to be presented to drawee for acceptance to make him liable and also for calculation of due date.

Negotiation

when a promissory note, bill of exchange, or cheque is transferred to any person to constitute that person the holder thereof, the instrument is said to be negotiated.

Negotiation of bearer instruments

A bearer instrument is negotiated by mere delivery and no endorsement is required.

Negotiation of an order instrument

An order instrument can be negotiated by endorsement followed by delivery. It may be noted that legal heirs cannot complete the negotiation of a negotiable instrument with endorsement by the deceased merely by delivery.

ENDORSEMENT

The signing of an instrument on the back of a slip of paper annexed thereto for negotiation is called endorsement (Section 15). The person who transfers the instrument is called the endorser and the person to whom it is transferred is called the endorsee. Various types of endorsements are as under:

1) Blank Endorsement

In a blank endorsement the endorser just signs his name without indicatingendorsee. It can be converted into full by writing name of a person above signatures. The effect of anendorsement in blank is that it makes an instrument drawn originally payable to order to bearer instrument for the purpose of negotiation which can be further negotiated by mere delivery.

2) Endorsement in Full

When the endorser indicates the name of the endorsee it is called a full endorsement.

3) Sans Recourse Endorsement

An endorsement in which the endorser excludes his liability is termed ‘sans recourse’ or ‘without recourse’ endorsement. In case of dishonour of the instrument, the amount cannot be recovered from such endorser.

4) Facultative

An endorsement in which endorser waives the notice of dishonour is called Facultative endorsement But this is not applicable to other parties to the instrument.

5) Restrictive endorsement

An endorsement which restricts further right of negotiation is called as restrictive endorsement. For example if it is written in the endorsement as “Pay to Hari for my use” itis restrictive endorsement.

6) Conditional Endorsement

When along with endorsement, a condition is imposed by endorser. For example, pay to C on completion of studies. Paying bank not to ensure compliance of condition. Condition binds endorser and endorsee only.

7) Back-to-Back Endorsement

An endorsement in which the endorser himself becomes endorsee iscalled as back to back endorsement and in such a case, the endorsee can recover the amount only from parties prior to his own endorsement.

8) Negotiation Back

When the drawer of a cheque himself becomes endorsee, it is called “Negotiation Back” and this cheque is treated as satisfied.

9) Partial Endorsement

The endorsement can be made only for full amount but in case part payment has been received and a note to that effect is made on the instrument, then the same can be endorsed for the balance amount.

10) Forged Endorsement

When an endorsement is made by a person other than the Holder by forging signatures of the Holder Title does not pass to any person based on such endorsement. A person getting an instrument after such endorsement does not become a holder.

Regularity of endorsement

The paying bank gets protection u/s 85(1) only when endorsement is regular (may not be genuine).

PAYMENT IN DUE COURSE

As per Section 10 of N.I. Act. ‘payment in due course means payment according to the apparent tenor of the instrument in good faith and without negligence to any person in possession thereof under circumstances which do not afford a reasonable ground for believing that he is not entitled to receive payment of the amount therein mentioned’.

Section 85 of the NI Act conditions to be satisfied for being a payment in due course.

- Payment is under the apparent tenor of the instrument,

- Payment must be in good faith and without negligence,

- Payment must be made to the person in possession of the instrument,

- The banker should not have any reasons to “disbelieve” the integrity/honesty of the possessor, i.e. no reasons to think that he is not entitled to receive the payment.

- Payment must be made in money only.

INCHOATE INSTRUMENTS

As per section 20 of the NI Act, an instrument on which the date, payee, or amount is not mentioned is called an inchoate or incomplete instrument. Incomplete cheque can be completed by the Holder and the completion so made will not be treated as material alteration.

An instrument without signatures is not treated as an instrument at all.

AMBIGUOUS INSTRUMENTS

Where the instrument is drawn in such a manner that it can be construed both as PN or BE.

In the following cases, the instrument is taken as ambiguous:

(a) Where drawer and drawee are the same person.

(b) Where drawee is a fictitious person. E.g. Lord Krishna etc.

(c) Where a drawee is a person incapable of entering into a contract.

SOME IMPORTANT SECTIONS OF THE NEGOTIABLE INSTRUMENTS ACT:

01 Indian Paper Currency Act 1871 not to be affected by the provisions of this Act.

04 Promissory note defined

05 Bill of exchange defined

06 Cheque defined (also include electronic cheque and truncated cheque)

07 Drawer, drawee in case of need, acceptor, acceptor for honour, payee defined

08 Holder defined

09 Holder in due course defined

10 Payment in due course: Paying banker’s protection if payment is made in due course

11 Inland instruments defined — drawn and made payable in India

12 Foreign instruments defined.

13 Negotiable instruments defined indirectly

14 Negotiation defined.

15 Endorsement and endorser defined

16 Endorsement in blank and in full and endorsee defined.

17 Ambiguous instruments

18 Difference in amount in words and figures. Amount in words to be paid

20 Inchoate stamped instruments – Holder has implied authority to complete the instrument..

22 3 days of grace are allowed on a usance Bill of Exchange/Promissory note.

25 When a BOE/PN matures on a holiday — due date on the next preceding working day.

26 A minor can draw, endorse deliver and negotiate a negotiable instrument to bind all parties except himself.

31 Banker’s obligation to pay cheque & compensate drawer for wrongful dishonour.

65 Presentment for acceptance to be made during the usual business hours.

80 If no interest rate is mentioned in the Promissory Note interest @ 18% p.a. is to be paid.

85-1 Paying banker protected by payment in due course of an order cheque which is properly endorsed by the payee or his agent.

85-2 Protection to paying banker in case of a bearer cheque.

85-A Protection to paying bankers in case of Bank drafts.

87 Material alteration renders NI renders void,

89 Protection to paying banker for the materially altered instrument.

99 Noting — must for foreign instruments

100 Protest — must for foreign instruments

105-107 Reasonable time — for presentment, dishonour, and transmission of notice

123 General crossing

124 Special crossing

125 Who can crass – holder, banker

126-127 Payment of cheque crossed generally or specially

128 Payment in due course of crossed cheques

129 Paying banker liable to the true owner for loss when payment is not made in due course.

130 ‘Not Negotiable’ crossing — the transferee does not get a better title than that of the transferor.

131 Protection to collecting bank for crossed cheques subject to compliance of conditions

131-A Protection to collecting bank for crossed bank drafts.

138 Drawer’s liability for cheque returned unpaid for insufficient funds

139 Unless proved otherwise, it will be presumed that the cheque has been issued for the discharge of a debt/liability.

140 The drawer cannot plead that he did not expect the cheque to be dishonoured.

141 Offences by companies

147 Offences to be compoundable

very essential ingredient in this writing. Good.,

Thank you for your feedback and appreciation 💐🙏🏻

Yes