Welcome to Banking Digest

The banking sector in India is witnessing a sea of change, and bankers’ businesses have become more complex and difficult in this knowledge-driven era of technology.

Core Banking Solutions, Digital Banking, and 24/7 Banking Services play a crucial role in modern banking development.

The website will be of great help to the new entrants in the banking industry especially for their orientation to the core operational areas of banking.

Our Latest Posts

KCC scheme was first introduced during the year 1998 for farmers on the basis of their holdings by the banks for purchase of agriculture inputs such as seeds, fertilizers, pesticides etc. and draw cash for their production needs. The scheme was further extended for the investment credit requirement of farmers viz. allied and non-farm activities in […]

VIGILANCE FUNCTION IN BANKS The dictionary defines Vigilance as being watchful and cautious to detect danger, being ever awake and alert. While being vigilant is important in all walks of life, the observance of vigilance becomes more critical in the financial sector and particularly for institutions like banks, which deal with public money. Banks, which […]

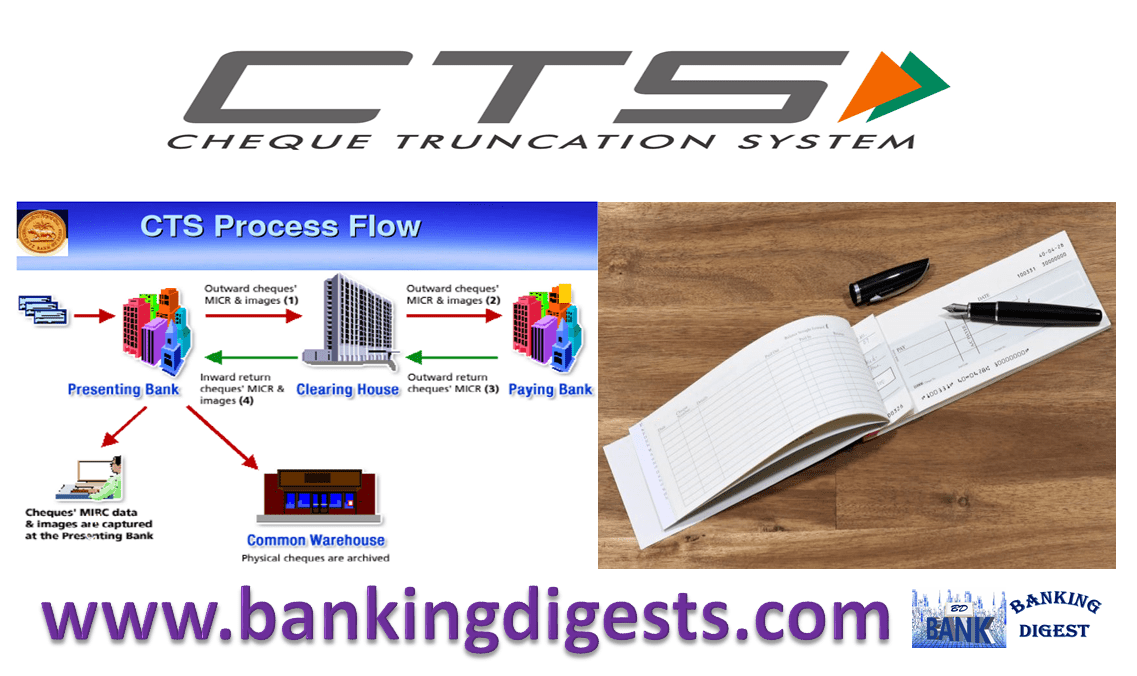

Introduction Truncation is the process of stopping the flow of the physical cheque issued by a drawer at some point by the presenting bank en-route to the paying bank branch. In its place, an electronic image of the cheque is transmitted to the paying branch through the clearinghouse, along with relevant information like data on […]

Reserve Bank of India (RBI) Governor Shaktikanta Das today announced a second tranche of liquidity boost for the economy. The announcements covered four key points: A 25 basis point reverse repo cut taking it to 3.75 per cent from 4 per cent earlier. The move has been taken to allow banks to lend more. A TLTRO […]

The relationship between a banker and a customer comes into existence when the banker agrees to open an account in the name of the customer. The relationship between a banker and a customer depends on the activities, products, or services provided by the bank to its customers or availed by the customer. Thus the relationship […]

Our Educational Videos

Our Books (Available on Amazon)

Meet our amazing team.

Abinash Mandilwar

Subscribe to Banking Digest By Abinash Mandilwar

Subscribe to Banking Digest By Abinash Mandilwar