Introduction To safeguard their advances, the bank accepts different types of securities during the lending and creates charges upon them. When land/buildings and fixed assets that are permanently fastened to the earth are offered as a security, it is charged by a mortgage in favor of a bank. When movable goods are offered as a […]

INTRODUCTION In India, the Negotiable Instruments Act was passed during 1881 which came into force from March 01, 1882. Originally, it had 137 Sections. Sections 138 to 142 were added in 1988, and Sections 143 to 147 were added during December 2002. At present it has 147 sections and 17 Chapters. It extends to the […]

PRESENT VALUE (PV) In finance, present value (PV), also known as present discounted value, is the value of an expected income stream determined as of the date of valuation. The present value is always less than or equal to the future value because money has interest-earning potential, a characteristic referred to as the time value […]

INTRODUCTION Letter of Credit is a guarantee letter issued by a bank in international trade in favor of the exporter that a buyer’s payment will be paid on time. If the buyer is unable to make payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase. […]

INTRODUCTION Bill finance is one of the major activities of the Banks. Under this type of lending, the Bank takes the bill drawn by the borrower on his (borrower’s) customer and pays him immediately deducting some amount as a discount/commission. The Bank then presents the Bill to the borrower’s customer on the due date of […]

INTRODUCTION Accounting aims to ascertain the financial performance of a firm. To do so the transactions have to be identified as capital or revenue in nature. This will determine whether they are placed in the Profit and Loss Account or the Balance Sheet. Let us study about capital and revenue expenditure and receipts. EXPENDITURE Expenditure […]

MEANING OF DEPRECIATION Depreciation is the reduction in the value of assets due to wear and tear. It is a method of allocation of the cost of the asset over its useful life. Every asset is subject to wear and tear in the normal course of its use and also over time. The cost of […]

Bank is an essential service sector organization. Customers play the most significant part in the bank. The customer is the one who uses the banking products and services and judges the quality of those products and services. A banking relationship is a contract between the Bank & the Customer. TYPES OF BANK CUSTOMERS During the […]

The concept of ‘Priority sector lending’ focuses on the idea of directing the lending of the banks toward a few specified sectors and activities in the economy. The term ‘priority sector’ indicates those activities which have national importance and have been assigned priority for development. These primarily include agriculture, small industries, etc. The case has […]

Bank Guarantee A Bank guarantee is a promise from a bank that the liabilities of a debtor will be met in the event that the debtor fails to fulfil your contractual obligations. It is a promise from a bank or other lending institution that if a particular borrower defaults on a loan, the bank will […]

Startup India: Startup India is a flagship initiative of the Government of India, intended to build a strong ecosystem for nurturing innovation and Startups in the country that will drive sustainable economic growth and generate large-scale employment opportunities. A start-up technically is any enterprise that is working on the growth, commercialization, and creation of brand-new […]

MSME is the pillar of economic growth in many developed and developing countries in the world. Though India is still facing infrastructural problems, lack of proper market linkages, and challenges in terms of the flow of institutional credit, it has seen tremendous growth in this sector. THE CREDIT GUARANTEE SCHEME (CGS) Businesses, especially MSMEs, […]

INTRODUCTION Banks undertake foreign exchange transactions for their customers. Foreign exchange is associated with foreign trade. The traders in the foreign exchange market (Authorized Dealers/brokers) rely on the two basic forms of analysis viz. fundamental analysis and technical analysis. The uses of technical analysis in forex are much like the share market where the price […]

Government of India launched Swarnjayanti Gram Swarozgar Yojana (SGSY) scheme after restructuring the Integrated Rural Development Programme (IRDP) from April 1, 1999 in the rural area of the country. SGSY was effective up to 31st March 2013. The Ministry of Rural Development, Government of India launched a new programme known as National Rural Livelihoods Mission […]

The Consumer Protection Act has been enacted for the purpose of providing timely and effective administration and settlement of consumer disputes and related matters. The Government instead of bringing an amendment in the 1986 Act, enacted a new Act altogether so as to provide enhanced protection to the consumers taking into consideration the booming e-commerce […]

PMEGP is a new MSME Scheme of Govt. of India by merging REGP and PMRY scheme launched on 04-04-2008. State Khadi & V.I. Board and District Industries Centre of State Government have also been associated in implementation of the programme. Special Package of subsidy to promote rural industrialization. Empowering entrepreneurs through Skill Development and entrepreneurial […]

TReDS Platform TReDS is an institutional mechanism set up to facilitate the discounting of invoices for MSMEs. It is an electronic platform for facilitating the financing / discounting of Micro, Small, and Medium enterprises (MSMEs) trade receivables through multiple financiers. These receivables can be due from corporates and other buyers, including Government Departments and Public […]

Introduction An advance made by a bank is generally covered by primary or collateral securities. The effectiveness of the security depends on the nature of security. The securities can be classified into two aspects, economic and legal aspects. The economic aspect covers marketability, valuation, and other economic factors of the security. The other legal aspect […]

Introduction To safeguard their advances, a bank accepts different types of securities during the lending and creates a charge upon them. When land/buildings and fixed assets which are permanently fastened to the earth is offered as a security, it is charged by a mortgage in favour of the bank. When movable goods are offered as […]

What is Forfaiting? Forfaiting in French means to give up one’s right. Thus, in forfaiting the exporter hands over the entire export bill with the forfaiter and obtains payments. The exporter has given up his right on the importer which is now taken by the forfaiter. By doing so, the exporter is benefited as he […]

Factoring finance in India Factoring is one of the upcoming sources of finance for SMEs in India. It is particularly, relevant if a company is growing daily and when new customers are added regularly; there are chances of ending up with huge invoices. This problem often directs many businesses to look for an alternative source […]

Banks and financial institutions finance the borrower after executing the security documents. On default of the loan, the bank and FI have to initiate recovery action and file suit against the borrower. The recovery act and court only permit action if the claim is within the period of limitation. The limitation act defines the limitation […]

It is of utmost importance to obtain appropriate and correctly executed security documents before disbursing an advance to borrowers. In case the borrowers fail to repay, the recovery of Bank’s dues, banks will mainly depend upon the enforcement of the security. Banks should, therefore, take necessary care and precaution while obtaining security documents in advance […]

बैंक में बढ़ते एनपीए और बकाये की वसूली की धीमी प्रक्रिया बैंकों के लिए महत्वपूर्ण चिंता का विषय है। लोक अदालत एक ऐसा मंच है जो विवादों के निपटारे में महत्वपूर्ण भूमिका निभाता रहा है। लोक अदालत बिना अदालतों का सहारा लिए न्याय दिलाने की एक प्रक्रिया है। इसकी प्रक्रिया स्वैच्छिक है और इस सिद्धांत […]

INTRODUCTION The mounting of NPAs in the Bank and the tardy recovery process of the dues is an important concern for the Banks. Lok Adalat is one of the forums which has been playing an important role in the settlement of disputes. Lok Adalat is a process of administering justice without resorting to courts. Its […]

Introduction of Tribunal Banks and financial institutions have been experiencing considerable difficulties in recovering loans and enforcement of securities charged with them. The procedure for recovery of debts due to the banks and financial institutions, which is being followed, has resulted in a significant portion of the funds being blocked. Mounting of NPA is a […]

BRIEF HISTORY OF RBI The Reserve Bank, as the central bank of the country, started its operations as a private shareholder’s bank. RBI replaced the Imperial Bank of India and started issuing the currency notes and acting as the banker to the government. Imperial Bank of India was allowed to act as the agent of […]

Banking sectors plays a pivotal role in the management of the economy of a country. It is the key driver of economic growth of the country and has a dynamic role to play in converting the idle capital resources for their optimum utilization so as to attain maximum productivity. In fact, the foundation of a […]

Agriculture in India is wholly dependent on nature. Crop insurance scheme has been implemented to protect the farmers from perils of nature. The Central Govt. has announced a new format of Crop Insurance in name of “Pradhan Mantri Fasal Bima Yojana (PMFBY)”, to be implemented from 1st April’ 2016. PMFBY was launched with aim to […]

To provide customers safety in cheque payments and reduce instances of fraud occurring on account of tampering of cheque leaves, RBI introduces a mechanism of Positive Pay for all cheques of value ₹50,000 and above. RBI Governor Shakti Kanta Das has announced of the same on 6 August 2020. The Reserve Bank of India (RBI) […]

In line with international practices and as per the recommendations made by the Committee on the Financial System (Chairman Shri M. Narasimham), the Reserve Bank of India has introduced, in a phased manner, prudential norms for income recognition, asset classification and provisioning for the advances portfolio of the banks to move towards greater consistency and […]

The issue of Non-Performing Assets (NPAs) in the Indian banking sector has become the subject of much discussion and scrutiny. When the borrower stops paying interest or principal on a loan, the lender institutions will lose money. Such a loan is known as Non-Performing Asset (NPA). Indian Banking industry is seriously affected by Non-Performing Assets. […]

A wilful defaulter is an entity or a person that has not paid the loan back despite the ability to repay it. The RBI has been initiating every effort to ensure that wilful default should not adversely affect the health of the banking system. The Reserve Bank of India (RBI) is in the process of […]

Banks in India are reeling from the overhang of bad loans on their books across both the public and private sector. After a prolonged period of stress, which saw the gross non-performing assets (GNPA) of scheduled commercial banks rising drastically. The Reserve Bank of India’s (RBI’s) Financial Stability Report (FSR) of December 2020 has […]

GARNISHEE ORDER A Garnishee Order is an order issued by court under provisions of Order 21, Rule 46 of the Code of Civil Procedure, 1908. The concept of ‘Garnishment’ has been introduced in civil procedure code by the amendment Act, 1976 and is a remarkable piece of legislation. This term has been derived from the […]

Your CIBIL Score is an evaluation of your credit history for determination of your loan eligibility. With many applicants looking for a loan, banks were increasingly finding it difficult to carry out intensive background checks regarding the credit-worthiness of the applicant. A Credit Information Company (CIC) is an independent organization licensed by the Reserve Bank […]

Micro, Small & Medium Enterprises (MSME) is the pillar of economic growth of India. MSME has played a prominent role in the development of the country in terms of creating employment opportunities- MSMEs contribute 29 per cent to India’s gross domestic product and comprise almost half of its exports. These units employ over 11 crore […]

Government of India, Ministry of Housing and Urban Poverty Alleviation has restructured the existing Swarna Jayanti Shahari Rozgar Yojana (SJSRY) and launched the NULM w.e.f. 24.09.2013. Scheme is operative in all districts headquarters irrespective is population and all cities with population of 1 lakh or more and that SJSRY was to remain operational till March […]

Internet banking has become one of the fastest and easiest way of banking. Information security issue is the most important one in using Internet and it becomes more crucial while implementing the Internet in banking sectors. This research revealed a lot of risks and threats to the security of online banking information which are increasing […]

Ministry of Housing and Urban Affairs, Government of India has come out with Scheme “PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi)” aimed for financing to street vendors to make them self-reliant and come out of distress situation due to COVID-19 pandemic and consequent lockdown. The PM SVANidhi scheme was launched by the Ministry of Housing […]

Introduction For the improvement of customer service in the banking industry, RBI has provided a platform to customers for redressal of banking-related disputes. RBI notified the Banking Ombudsman Scheme 2006 u/s 35 A of Banking Regulation Act 1949. The scheme came into force effective from 01st Jan 2006. It covers all commercial banks, RRB’s & […]

Pradhan Mantri Awas Yojana (PMAY) is a mission started with an aim ‘Housing For All’ (HFA) scheme by NDA Government to be achieved by the year 2022, that is when India will be completing its 75 years of Independence. The mission started in 2015 and will be attained in seven years i.e., during 2015 – […]

INTRODUCTION To consolidate framework of rules and regulations on Housing Finance issued by RBI Master Circular DBR.No.DIR.BC.13/08.12.001/2015-16 dated July 1, 2015. In pursuance of National Housing Policy of Central Government, Reserve Bank of India has been facilitating the flow of credit to housing sector. Since housing has emerged as one of the sectors attracting a […]

The basic objective of the Right to Information Act is to empower the citizens, to promote transparency and accountability in the working of the Government, and public authority. The act helps to mitigate the corruption, and to enhance people’s participation in democratic process, so that our democracy work for the people in a real sense. […]

KCC scheme was first introduced during the year 1998 for farmers on the basis of their holdings by the banks for purchase of agriculture inputs such as seeds, fertilizers, pesticides etc. and draw cash for their production needs. The scheme was further extended for the investment credit requirement of farmers viz. allied and non-farm activities in […]

VIGILANCE FUNCTION IN BANKS The dictionary defines Vigilance as being watchful and cautious to detect danger, being ever awake and alert. While being vigilant is important in all walks of life, the observance of vigilance becomes more critical in the financial sector and particularly for institutions like banks, which deal with public money. Banks, which […]

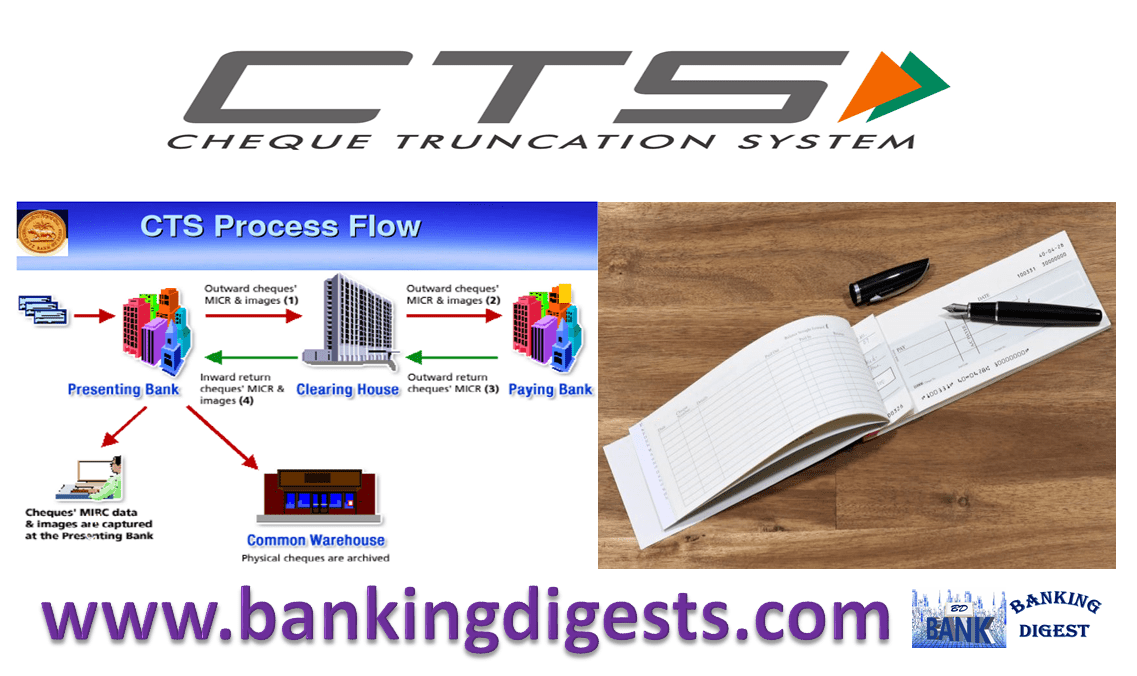

Introduction Truncation is the process of stopping the flow of the physical cheque issued by a drawer at some point by the presenting bank en-route to the paying bank branch. In its place, an electronic image of the cheque is transmitted to the paying branch through the clearinghouse, along with relevant information like data on […]

Reserve Bank of India (RBI) Governor Shaktikanta Das today announced a second tranche of liquidity boost for the economy. The announcements covered four key points: A 25 basis point reverse repo cut taking it to 3.75 per cent from 4 per cent earlier. The move has been taken to allow banks to lend more. A TLTRO […]

The relationship between a banker and a customer comes into existence when the banker agrees to open an account in the name of the customer. The relationship between a banker and a customer depends on the activities, products, or services provided by the bank to its customers or availed by the customer. Thus the relationship […]

Nomination is the right conferred upon the holder of a bank account to appoint one or more persons who will be entitled to receive monies upon the death of the account holder. In the event of death of an account or locker holder, the bank can release the account proceeds or contents to the nominee […]

RBI has issued a Master Circular on Customer Service in Banks on July 1, 2015. RBI explained the Settlement of claims in respect of deceased depositors in bank. As per the circular, RBI has simplified the procedure the settlement process in deceased account payment. According to provisions of the Banking Regulation Act, Banks should adhere […]

RBI constituted committee on Procedures and Performance Audit of Public Services in November 2003, under the chairmanship of Shri S. S. Tarapore (former Dy. Governor) to address the issues relating to availability of adequate banking services to the common man. Therefore, RBI, in its Monetary Policy Statement in April 2005 announced setting up of the […]

The Bank is committed to following fair practices especially with regard to collection and recovery of its dues from its borrowers (hereinafter referred to as “customer”). At the same time the Bank is also committed to follow fair practices in this regard to foster customer confidence and to retain the image of the Bank […]

Lending is an important activity of the banking industry. Bank invests public deposits in the form of lending and earns a profit. The quality of the advances indicates the bank’s image in the market. A banker should have a thorough knowledge of the requirement of the customer and should be in a position to cater […]

The Reserve Bank of India (RBI) is the regulator of foreign exchange dealings in India. It prohibits, restricts, and regulates the opening, holding and maintaining of foreign currency accounts, and the limits up to which a person resident in India can hold the amount in such accounts. These regulations are known as Foreign Exchange Management […]

The main function of the banks is to mobilise deposit from public and lend that deposit to individual, firms and corporate institutions. Banks offers various types of deposit products which can be broadly classified as Demand Deposits and Term/Time Deposits. Difference between Demand Deposits and Term/Time Deposits are as follows. Demand Deposits Term or Time […]